Can Quartz become a scrappy media startup?

The business news site went independent in 2020 and is betting much of its future on paid memberships.

Welcome! I'm Simon Owens and this is my media newsletter. You can subscribe by clicking on this handy little button:

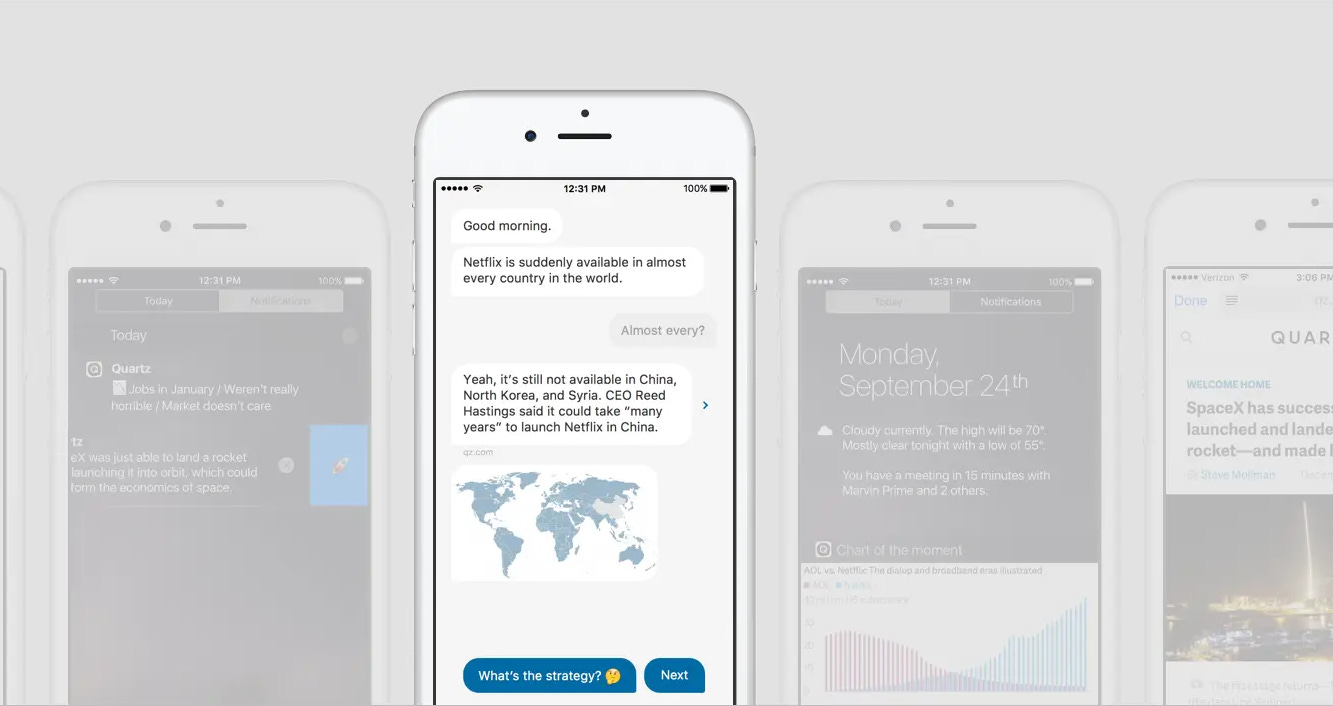

One thing that amazed me while researching the online magazine Quartz was how often it pushed the boundaries for how a 21st century media company could operate. At the same time that nearly every other publisher was aggregating John Oliver video clips in pursuit of Facebook traffic, Quartz was launching chatbots, chart-building tools, and augmented reality tech. It also experimented with dozens of niche verticals, beats, and regions of coverage. From its very beginning, the publication was never content with simply following industry trends.

And yet it was hard for me not to wonder whether any of these bets actually paid off. After a few years of traffic growth and even reaching brief profitability in 2016, Quartz seemed to stall out. Both its revenue and audience declined the next year, in part because of Facebook’s pivot from news, and it looked, at least to outside observers, as if the site was struggling to regain its footing.

In 2018, The Atlantic sold the publication to Uzabase, a media company based in Japan, and though the announcement touted all the supposed synergies between the two companies, Quartz’s struggles continued. The company went through multiple batches of layoffs in 2019 and let go of nearly half of its staff in mid 2020. According to financial filings and reporting from The New York Times, revenue and traffic numbers kept sliding throughout 2019 while Uzabase’s losses mounted. Then the pandemic hit, and its advertising business cratered.

In November 2020, Uzabase made a shocking announcement: it was selling Quartz to CEO Zach Seward and editor-in-chief Katherine Bell. The announcement meant that, for the first time in its history, Quartz would be acting as an independent entity, unmoored from a well-funded corporate mothership. The publication presumably now relies mostly on the revenue it generates to fund its journalism. In some sense, this means it must operate like a media startup — one that depends on organic growth — while trying to compete with much larger, better-funded news behemoths.

Not everyone is convinced that a small player can compete with the Bloombergs and Wall Street Journals of the world. In June of last year, Digiday’s Steven Perlberg argued that Quartz was “not quite niche enough to be essential to a small group of readers, but not quite big enough to compete at scale.”

Can Quartz thrive as an independent media company? To answer this question, I spoke to some of its top executives. I also spent a few hours reading through its apps, articles, and newsletters to get a sense of how it differentiates itself from other business news players. Let’s dive into what I found...

“An amicable divorce”

To get a sense of where Quartz is going, I first wanted to understand why it had struggled to maintain its footing under corporate ownership. Was it hindered by executives too far removed from its central business, as seemed to be the case for other digital news outlets like HuffPost?

Back in March I spoke to Zach Seward, Quartz’s CEO and co-owner. Seward was one of its earliest employees; he followed his boss Kevin Delaney over from The Wall Street Journal in 2012 to found the company. He started as a senior editor before gradually moving over to the product side. He was promoted to chief product officer in 2018 and then to CEO in 2019 when Delaney stepped down.

For its first several years, Quartz relied entirely on advertising — selling customized, native ads to high-end brands that were interested in reaching its global audience. In our conversation, Seward argued that this strategy was an unmitigated success. “We grew the ad business on its own to be profitable by 2016,” he said. That’s when The Atlantic decided to invest more in the business, rapidly expanding its headcount on both the editorial and product side. Because of this investment, Seward explained, its expenses began to outpace revenue growth.

When Uzabase purchased Quartz in 2018, Seward still believed it was on the path to profitability. But not long after the acquisition, the company’s priorities seemed to waver. “They came under pretty intense pressure from investors to improve the profits from what the Japanese businesses were generating,” he said. That meant focusing on Uzabase’s already-existing data and news app products. The board of directors completely turned over, which, according to Seward, meant that the new board didn’t feel any ownership over the decision and therefore wasn’t compelled to defend it. Then came the pandemic and greater-than-expected losses. “They could have chosen to double down and invest in the long term,” he said. “I certainly believe it would have been the smarter move on their part. That’s not what the board decided.”

So in the summer of 2020, the company kicked off an M&A process to see if it could find a buyer for Quartz. How that then led to Seward and Bell buying the company is still unclear, since they’re bound by confidentiality agreements. “We can’t release the terms of the transaction, so it makes it a little hard to fill in the gaps, but it is as straightforward as it sounds; I and Katherine Bell bought the company,” he said. “Suffice it to say, I haven’t been sitting on some vast wealth. We were able to negotiate terms to make it possible to buy the thing outright, and doing that, we would plan to seek out further financing for our ongoing billing operations.” Aside from his assertion that more patience would have been warranted, Seward didn’t badmouth Uzabase. “It was an amicable divorce.”

A future built on reader revenue

According to a Quartz spokesperson, advertising still makes up the vast majority of Quartz’s revenue, and while it plans to continue growing that business, the pandemic-induced hit to the publication’s bottom line really drove home for Seward the notion that it needs a stronger, more reliable foundation. “The biggest volatility in our business in terms of revenue has been on the advertising side of things,” he said.

That foundation will come in the form of reader revenue. In 2018, Quartz launched a membership program that gave customers access to exclusive content and other perks, but the vast majority of its articles remained free. Then several months later it rolled out a metered paywall to strengthen the value of a membership; in exchange for $100 a year, members still received exclusive content, but it also guaranteed them unlimited access to the entire site.

Overseeing Quartz’s membership program is Walter Frick. Prior to his hiring in November 2019, he had spent six years as an editor at Harvard Business Review. When he joined Quartz as executive membership editor, the program was almost exactly a year old. Back then, the magazine only had a few thousand members, and Frick came in with the mandate to vastly expand that business.

So what drives someone to become a paying Quartz member, and how has its offering evolved since it became an independent company?

First, let’s talk about the less tangible selling points that are tied to its mission and independence. When Quartz announced the deal in November, it unveiled a new tagline: Make business better. “A membership program like ours needs to be clear what it’s about and what we’re trying to do,” said Seward. “Quartz exists in order to help make business better, in all the ways that you can interpret it — from the way business is conducted to how we hold business accountable to the impact on society.” By adopting a progressive stance, he argued, Quartz could attract members who were aligned with its mission. “We had never been explicit about how we take a progressive approach to our journalism, and we thought it was important to be explicit.”

Quartz paired this new mission statement with messages about supporting independent journalism. Frick told me that his team prepared an email to go out to all newsletter subscribers a few days after the deal was announced. “We told them that we’re now an independent company and that they can support us by becoming a paid member of Quartz. That was the best day for member signups since I’ve been at the company.”

While that announcement triggered a one-time boost in memberships, the biggest member-exclusive draw is what Quartz refers to as its “field guides.” They’re essentially weekly themed “issues” that contain about a half dozen articles anchored by a single, longform feature story. For instance, a November field guide on climate tech features six articles with titles like “The current state of climate tech” and “How to finance a climate tech startup.” All are locked behind a hard paywall.

With each field guide, Quartz is trying to give a definitive deep dive into some changing aspect of the global economy. “The majority of them are written by our internal reporters,” said Frick. “Occasionally we’ll get a freelancer. We’re planning between five and 10 weeks out, assigning stories to reporters. Ideally it’s building on work they’re already doing.” Four out of the six articles in the climate tech field guide, for instance, were written by staff climate reporter Michael J. Coren.

It probably won’t surprise you that newsletters are Quartz’s best conversion channel for new members. For years, the publisher has invested heavily in both its daily and weekly newsletter products; in fact, its homepage is a modified version of its Daily Brief newsletter. A newsletter will often convert in one of two ways. “They might see something they particularly want to read and hit a paywall,” said Frick. This includes the metered stories and the field guides, which are heavily promoted within the newsletters. “Or they see a message touting a membership offer that’s tied to a discount, and they decide today is the day to subscribe.”

Frick’s team also developed a member-only newsletter that packages each week’s field guide in a more easily digestible format.“We want to save members time,” he said. “We know that they want to understand these topics, but they don’t want to take the time to read every word of every package, so what they get is this email that boils it down to key data points and overviews.”

During the pandemic, Quartz ramped up its virtual events offerings and used them as a lead magnet, requiring attendees to turn over their email addresses as the price for admission. “The live event is available to anyone with an email signup,” said Frick. “But the recordings and summaries of those events are just for members.”

In recent months, Frick has devoted quite a bit of attention to driving more conversions through the metered content, mostly by tweaking the way the meter works. After experimenting with multiple article limits, he’s since deployed a dynamic paywall that attempts to predict when a reader is most likely to subscribe. “The current version uses machine learning,” he said. “It assigns attributes to the content and where the person is coming from, and then it uses a scoring system. You might have a different experience if you’re a regular Daily Brief reader compared to if you’re coming to an article from, say, Google.”

Digiday reported that in January 2020 that Quartz had 10,000 paying members and that it grew to 17,860 by the end of April. By November it was up to 25,000. In March, a spokesperson told me the publication had grown to 27,000 paying members and that it was expecting more than $3 million in subscription revenue this year. “Advertising is still the vast majority of our revenue, and it will take years for the two businesses to be in parity,” she wrote in an email.

Leaning into its global appeal

It was clear from my conversations with Quartz employees that the magazine is extremely proud of its global audience. “Roughly, just over half of our members are outside the U.S., so I think that’s a big way we distinguish ourselves compared to our competitors,” said Frick. It’s actively hired writers across Africa and Asia and has built out several verticals to cover those markets.

The other day I visited Quartz’s homepage and began clicking on headlines at random. I landed on articles about India’s farmer protests, the worker shortage in the U.S., and startup regulations in Africa. All three were under a thousand words and contained little in the way of original reporting. Instead, they seemed structured to contextualize these complex issues for a Western audience; it reminded me of the short pieces published by The Economist, which Quartz has often compared itself to.

Seward told me he wants to lean into these geographic verticals even more by launching subscription products around them. He said that Quartz Japan — a vertical that grew out of its Uzabase ownership — is already offering such a subscription, and he wants to roll one out in Africa next. “We’re looking for an editor and expanding the number of reporters to help support that.”

Indeed, in the time since I spoke with Seward in March, Quartz has begun hiring again. In May, it announced six new roles that spanned across Taipei, Nairobi, New York, DC, and San Francisco. It’s still much smaller than it was pre-pandemic, but these are early signs that Quartz’s transition into a media startup is working.

For years, many assumed that digital news outlets needed to be snapped up by larger conglomerates in order to achieve profitability. But recently we’ve seen startups like Defector, Morning Brew, and any number of Substack newsletters thrive with just their small, devoted audiences. It turns out that when you’re not chasing scale for scale’s sake, a passionate readership is all you need to build a sustainable business. Given Quartz’s devotion to its own audience, it’s hard not to root for it to succeed.

Do you like this newsletter?

Then you should subscribe here:

Simon Owens is a tech and media journalist living in Washington, DC. Follow him on Twitter, Facebook, or LinkedIn. Email him at simonowens@gmail.com. For a full bio, go here.